If you are looking for a reliable platform to open an account and manage it as simply as you operate your regular bank account, opening an Opay account will deliver you maximum cooperation.

What does Opay mean

Opay which stands for "Opera payment" is the Nigerian-based online digital payment system used for sending and receiving money or making online payments.

The platform was launched by Opera company, backed with a License from the central bank of Nigeria (CBN), and insured by the Nigeria deposit insurance corporation (NDIC). It started operation in Nigeria in the year 2018 with some southern parts of the country and is currently covering the whole 36 states including the FCT.

It also served as the only medium of payment to Opera news content creators.

In this article, I will show you how to open your new Opay account without visiting any agent, you just use your mobile phone and an active phone number as your Opay account number. And subsequently, you will learn how to make money transactions with it.

See Also: How to make money on Opay

How do I open a new Opay account

You can either visit Opay's official website or download a mobile app on your Android or iOS phone, or use the *955# USSD code to open your new Opay account.

If you are ready to start, you can choose the most convenient method for you. Here is the website link.

The procedure is the same for both the website and mobile app.

If you are opening through the website tap on three dot lines at the top right-hand and click Create an account.

And for mobile apps, you will visit and install the application in the Android play store or Apple app store and proceed with account creation.

1. If you're using the mobile app after you installed and launched it, tap on < create a new account >.

Enter your phone number >>> then tap Get OTP

2. You will receive a 6 digits code through your phone number, input it, agree with the terms and conditions, and click < confirm >.

3. On the next page you will create a password which must consist of six different numerics long. If you are invited by someone and you have an invitation code then enter it to receive a bonus. Then click < Done >

4. Once you click on "done" you would be taken into a picture snapshot window where you will snap your profile picture.

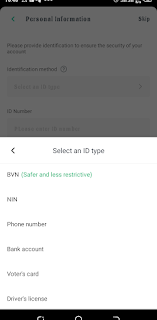

5. On the next screen, you will choose one means of identification (optional) and enter the ID number for maximum security of your account. You can skip this process until the next time.

6. If you skip identification you would fill in a form with your personal information.

7. the next page is for your address details, fill in and continue.

Once done, your new Opay account was successfully created.

8. Then you can add an email address to your account which helps you receive any change made in your account such as password change etc.

Related article: What is eNaira and how to use it

How to Log in to your Opay account

If you signed out from your account, next time you are only required to enter your phone number (which is your account number) and your six digits password and hit the sign-in button, you will receive six digits code, enter and click verify. This applies to both the Opay app and website.

How to transfer money to the Opay account

Funding an Opay account with money is an easy task and there are different methods to do so:

It is similar to the way you are making transfers to other bank accounts, just launch any of your mobile bank applications, and head to the transfer section. Your Opay account details are as follows:

• Your account number is exactly the phone number you used to create your Opay account. If your phone number is 08012345678 then your Opay account number associated with that number shall be 8012345678 except for the first digit.

• Your account name is the same as the name used in creating an account.

• Also your bank name is Opay.

Your Opay account will get funded as soon as your transfer is successful.

Method two: Top up with a debit card or bank account:

After you Lunch your Opay app, tap on < Add money > and select the second option, >>>enter the amount >>> then add new payment option>>> enter your debit card or bank details and BVN, then clicks confirm to transfer your funds from that bank into your Opay account.

Method three: Cash deposit

Give cash to one of the POS merchants such as Opay, Kredi, Kudi, Moneypoint, or Palmpay to transfer to your Opay account.

Other methods include using a USSD code (*955#), Sending requests to other Opay users to fund you, or scanning your Opay QR code.

Also Read:

How to transfer funds using an Opay account

If you have an Opay account funded with money you can make the transfer to any bank account and or to another Opay user both of which are free of charge.

To transfer a funds to bank account, launch your app and click on transfer, then select " To bank account", enter transaction details, and click < next >

Meanwhile, if want to transfer from your Opay account to another Opay user, select the second option and enter the receiver's phone number or Name or Opay account number.

You can also scan a QR code of the beneficiary if you are transferring to an Opay user.

Does Opay have USSD Code

What are the advantages of having an Opay account

With an Opay account, you can perform many tasks asides from sending and receiving money such as:

- Airtime and data purchase.

- Electricity Bill Payment.

- Payment for a TV subscription.

- Request for loans.

- Make online shopping.

- Pay for school and exam fees like WAEC.

- Internet service payments.

- Travel and Hotel payments.

- Government payments

- Chinese embassy visa payments, etc.

You may interested in reading: What is the Foreign exchange market (FOREX TRADING)

Some Exclusive Features of the Opay platform

- Ensure Account and funds security.

- Licensed by CBN and insured by NDIC

- Easy to open an account in less than 30 minutes.

- Free transfer and instant payment of funds.

- It enables Scheduled funds transfer.

- A reliable debit card is acceptable in all ATMs, POS, and online channels.

- Free instant virtual card for online payments.

We hope this article helps you learn how to open an Opay account, if you still have any questions feel free to drop them in the comments section, we're always here to help.

Also, remember to share this article with your friends.

![How to Find a Lost or Stolen Phone [Google Find My Device]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiuHlG0tF26ok96uSXIKOQ-R51eQb_ogxUlLUsVbX3o7AhO_Gs8wvlbWYwbkO9a4tSxE-pv_sOoX1exCWZZCtX25wPbngvbCwN7clFk1N5QWG75-WkY4Hy352mmcXfi4X8nWXx9LjwsunPg_RgRbMyGiZ9but9eifKtSn-lwn1eUUfY-dpYDWGkHi3s/w72-h72-p-k-no-nu/Screenshot_20230224-112507.png)

![3 Best Browsers For Android Phones [Tested and Confirmed]](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjCRf5Zv4oH-ozjIzE5KQn_UtZlbL67XXDF8cFY9f06iYtR_QrUb3vDCPuPtt35uyI-gj5ueASBKVsDyhpjnVt5GV_G4mJXypsJj-Bm2apH8210nbrrQUUgnxOurE55dVHfssJCQpAWmmg0tEUQopArCu4DzmiS8kynkI_Y7EJv7Z3-40KH1xsT5ReXgJo/w72-h72-p-k-no-nu/1688908227364logo.png.png)

0 Comments